- /

- Mortgages

- /

- Buy to Let Mortgages

Buy to Let Mortgages

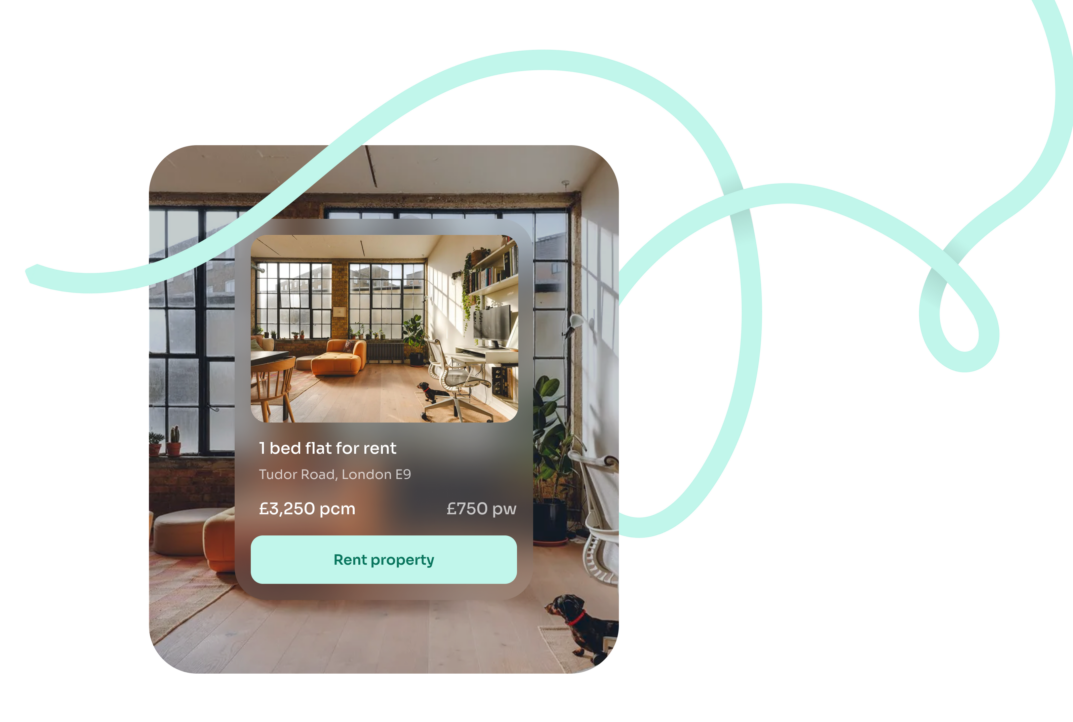

Looking for a Buy to let mortgage? Explore options for new landlords, experienced investors, and accidental landlord mortgages.

Your mortgage is secured against your home, which means your property may be repossessed if you fail to keep up with your mortgage payments.

Buy-to-Let mortgages are specifically for properties you’re looking to purchase with the intention of renting out, or remortgaging existing rental properties.

It can also be a great solution if you are looking to expand your property portfolio. While similar to standard mortgages, buy-to-let applicants are assessed differently. We’ll look at the rental income on your property, or the expected rental income on a new property, rather than your personal earnings. The loan amount you can borrow will be influenced by the expected rental revenue from the property.

What is the criteria for a buy-to-let mortgage?

To be eligible for a buy-to-let mortgage with us you’ll have to meet the following criteria:

Your mortgage is secured against your home, which means your property may be repossessed if you fail to keep up

with your mortgage payments.

What is an interest-only buy-to-let mortgage?

The interest-only buy-to-let mortgage is when the monthly payments you make goes towards the interest on the loan only. This means that, if you do not make any overpayments, the full loan amount remains outstanding and at the end of the term the balance must be repaid

in full.

It’s essential to have a repayment strategy, to clear the loan balance, in place before committing to an interest-only mortgage. If you don’t you might face financial issues when it comes to clearing the loan at the end of your term.

What is a consumer buy-to-let mortgage?

As a homeowner, you might find yourself needing to rent out your property due to a change in personal circumstances — this is known as becoming an accidental landlord. An accidental landlord is someone who ends up renting out a property, when they didn’t have the intention of becoming a landlord. This is an example of a consumer buy-to-let mortgage

If you’re in any doubt as to whether you need a buy-to-let or consumer buy-to-let (CBTL) mortgage, our mortgage advisors are here to help guide you.

Mortgage calculator

Curious about how much you might be able to borrow? By sharing a few details about your income and expenses, we can:

Give you a handy estimate of how much you could borrow.

Show you the home loan options we have available

Help you get a feel for what your monthly repayments might look like.

Let’s make it easier to plan your next step!

How to apply for a

mortgage when you

buy-to-let

Applying for a mortgage with us is easy. Just follow these simple steps:

Arrange a chat with a mortgage advisor

To apply for a mortgage with us, simply use our

appointment booker to book a chat with one of our mortgage advisors.

We’re just a call away

Or, if you’d prefer, give us a call and one of our experienced mortgage advisers will be delighted to assist you.