Savings Accounts with Afin

Discover simple savings accounts in the UK that work for your needs. Explore Fixed Term Saver and Notice Saver options for your growth with Afin.

Saving your money can be

hard at the best of times. So

here at Afin, we’ve made it

simple.

If you’re saving towards your future, our savings accounts are designed to help you grow your savings as easily as possible. And to make it as simple as possible, it’s all manageable using our easy-to-use app.

Ready to open a Savings Account in the UK? We’re here to help.

Why save with us?

Our savings accounts are designed to suit your savings needs and to help meet your goals. Here’s why opening an Afin savings account might suit you:

Competitive rates

When you bank with us, we offer competitive rates on your savings with our Fixed Term Saver and Notice Saver Account options, depending on your saving goals.

Simple and secure

Our user-friendly mobile app, with comprehensive security features, makes opening a savings account and managing your savings as secure as possible.

FSCS protection

Your eligible deposits with Afin Bank are protected up to a total of £85,000 by the Financial Services Compensation Scheme, the UK’s deposit guarantee scheme. Any deposits you hold above the limit are unlikely to be covered.

Our savings accounts

Picking the right savings account for you is simple at Afin. Here’s a quick comparison to help you weigh up your options:

Fixed Term

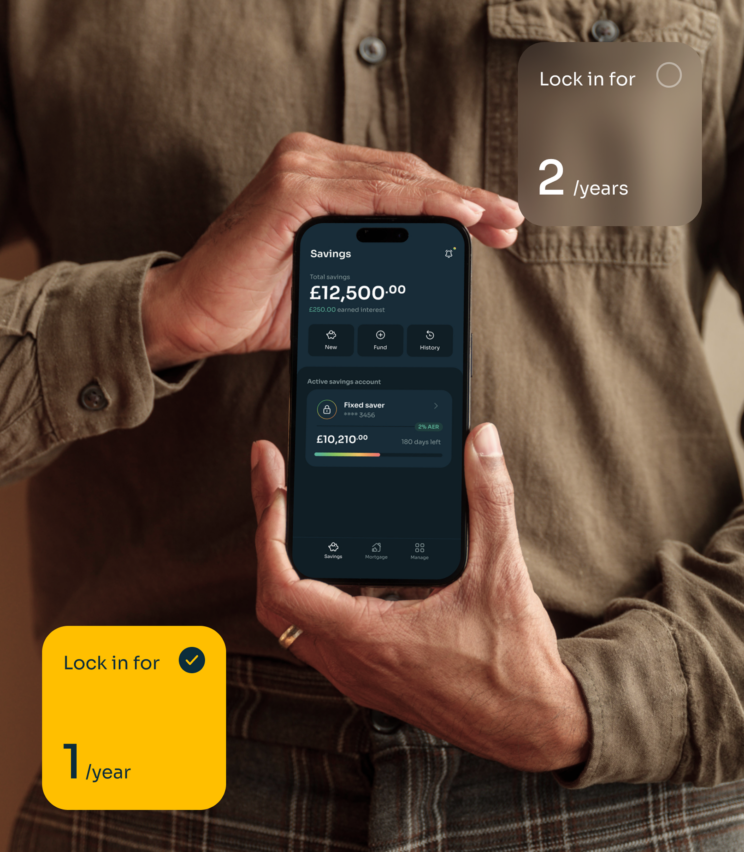

When looking for high-interest savings accounts in the UK, choose our Fixed Term Saver option if you’re planning to lock your money away for a guaranteed return.

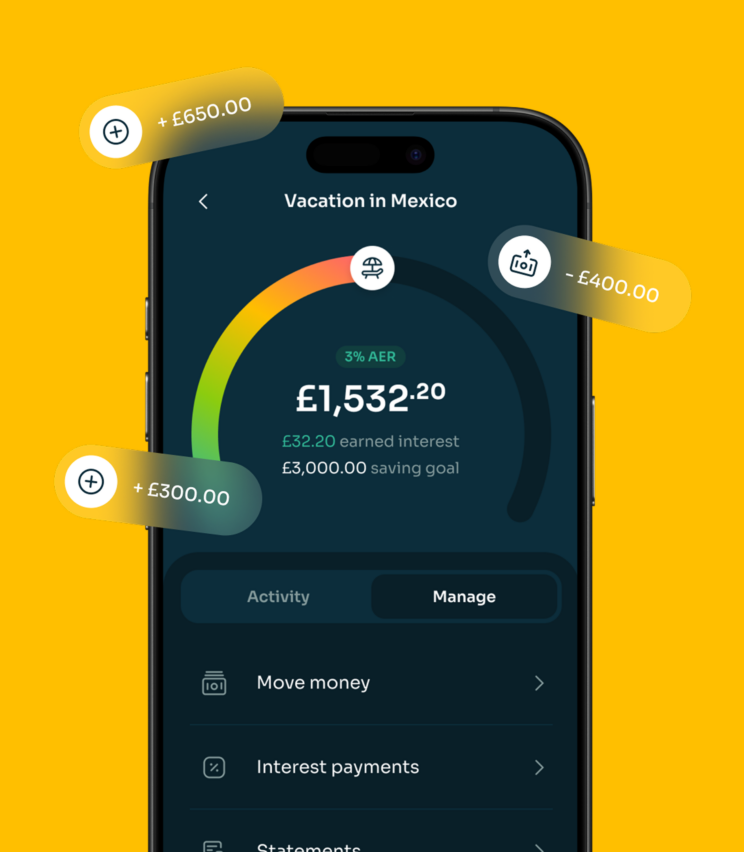

Notice Saver

When you want more flexibility and access to your savings, choosing a Notice Saver Account could also be the best option for you while building interest.

FAQs

Show all FAQs-

How do I apply for a savings account?

Opening an account is simple and can be done through our mobile app. You can find it [ XXX]

Here’s what you’ll need to get started:

- Your contact details

- Your email address

- Valid Identification document and proof of address – see question What account opening checks do you carry out?

- Details of your UK current account that you’d like to register as your Nominated Bank Account.

Please note that applications are only accepted through our mobile app and can’t be processed over the phone or via post.

If you need any help along the way, our Customer Service Team is here to guide you. Don’t hesitate to reach out – we’re here to make your experience seamless and stress-free.

-

What do I need to open a savings account with Afin Bank?

To open a savings account with Afin, you will need to:

- Be 18 years or older.

- Open the account for your personal use (we currently don’t support accounts for clubs, charities, or accounts held in trust).

- Be a UK resident for tax purposes.

- Provide a valid identification document and proof of address – see question What account opening checks do you carry out?

- Have a valid mobile phone number and email address so we can stay connected with you.

- Already have a UK current account in your name to be your nominated account which you can use to transfer money to and from your Afin savings account.

-

What personal documents do I need when applying for an account?

To ensure your account is set up smoothly and securely, you’ll need to provide some identification. Don’t worry—it’s a simple process.

Valid ID Documents

To verify your identity, please provide one of the following:

- Passport

- EU identity card

- Biometric residence permit

- UK driving licence (full or provisional)

Proof of Address

We will need to confirm your address and a document to verify this. You can use any of the following, if they are valid and recent:

- Full or provisional UK driving licence (if not already used as your ID)

- Bank, credit card, or mortgage statement (less than 3 months old)

- Utility bill (less than 3 months old)

- Council Tax bill (issued within the last 12 months)

- UK Government letter, such as a benefits confirmation, poll card, or tax code notice. (issued within the last 12 months)

A Quick Tip

To make the process seamless, ensure the name on your proof of address matches the name on your ID document. We’re unable to accept documents with shortened or mismatched names.

-

Can you help me with my application?

At Afin Bank, we’re here to provide clear, fair and accessible support. If you have any questions about applying for an account or require additional support, we offer several ways to get in touch:

How to Get in Touch

Email Us at: support@afinbank.com.

Call Us: Speak with our friendly team at 0333 344 2974. We’re available Monday to Friday, 9 am to 5 pm (except bank holidays).

Accessible Formats: Need information in braille, large print, audio, or another format? Email us at support@afinbank.com, and we’ll provide what you need.

At Afin Bank, we believe everyone deserves helpful and accessible support. If you need anything, please get in touch. We’re always happy to assist.

-

What do I need to do to make a deposit?

Your welcome email will provide all the details you need to make a deposit into your account. This includes your sort code and account number, with the payee’s name being Afin Bank.

Important Information:

- Sort Code Recognition: When you enter the sort code, your bank may identify it as a Clear Bank account. This is because we use Clear Bank as our clearing bank.

- Payee Name: Ensure you use your name as the payee’s name.

- If your bank gives you a “no match” or “unavailable” message, double-check that you’ve entered the sort code, account number, and payee name (Afin Bank) correctly. Once corrected, you should see a “match” message.

- If you are still seeing ‘No Match’ or ‘Unavailable’ and the details are correct and you still see this message, please contact your bank or building society for assistance.

Applying for

a savings account

To apply for a savings account with us, you simply need to download our app, available on iOS and Android.

Once you’ve opened an account, choose the savings account that works best for for your needs.

Deposit your funds and start saving. Your journey starts here!